- Ritesh Malik

- Posts

- The Slippery Slope Trap

The Slippery Slope Trap

the moment I understood this trap

The moment I understood the slippery slope trap: I’d gone for my usual morning walk in the park with my friend Deepak back in 2012 (name changed).

Me: I’ve been studying the Augmented Reality Space. And I think there is an opportunity in the AR space for me to pursue; as a founder.

Deepak: If you leave medicine now, you'll never be able to come back. Then you'll fail at business because you have no experience. Then you'll have wasted your medical degree. Then you'll have no career at all. Think twice, Ritesh.

Now see, Deepak did in fact care about me. He wanted the best for me.

But the issue is he fell into the trap of the classic slippery slope thinking.

TLDR: Thinking that one decision leads to an inevitable chain of disasters.

Here's what actually happened: I did leave medicine. AdStuck (my first venture) was a modest exit to Times Group. That experience taught me lessons that helped build Innov8 into a multi-million dollar exit company to Oyo backed by Softbank. The "career destruction" never materialized.

The slippery slope fallacy is your brain's way of protecting you from change by imagining the worst possible chain of events. It sounds logical, but it's actually keeping you trapped in mediocrity.

If you've ever thought:

"If I quit my job, I'll never find another one"

"If I start a business, I'll lose all my savings and end up bankrupt"

"If I move cities, I'll lose my network and have to start from zero"

The issue is when you start thinking like this, you stop taking risks. You stop progressing (in most cases) and tend to become averse to change.

But you're not being realistic. You're being a victim of faulty pattern recognition.

Remember the last time you’ve done this? Let me know here

Our brains evolved to keep us alive, not successful.

When you consider any change, your amygdala (fear center) immediately projects worst-case scenarios to keep you safe.

Corner and Hahn actually did a study on this too in 2011.

They showed people different scenarios. For instance (this is one im sharing):

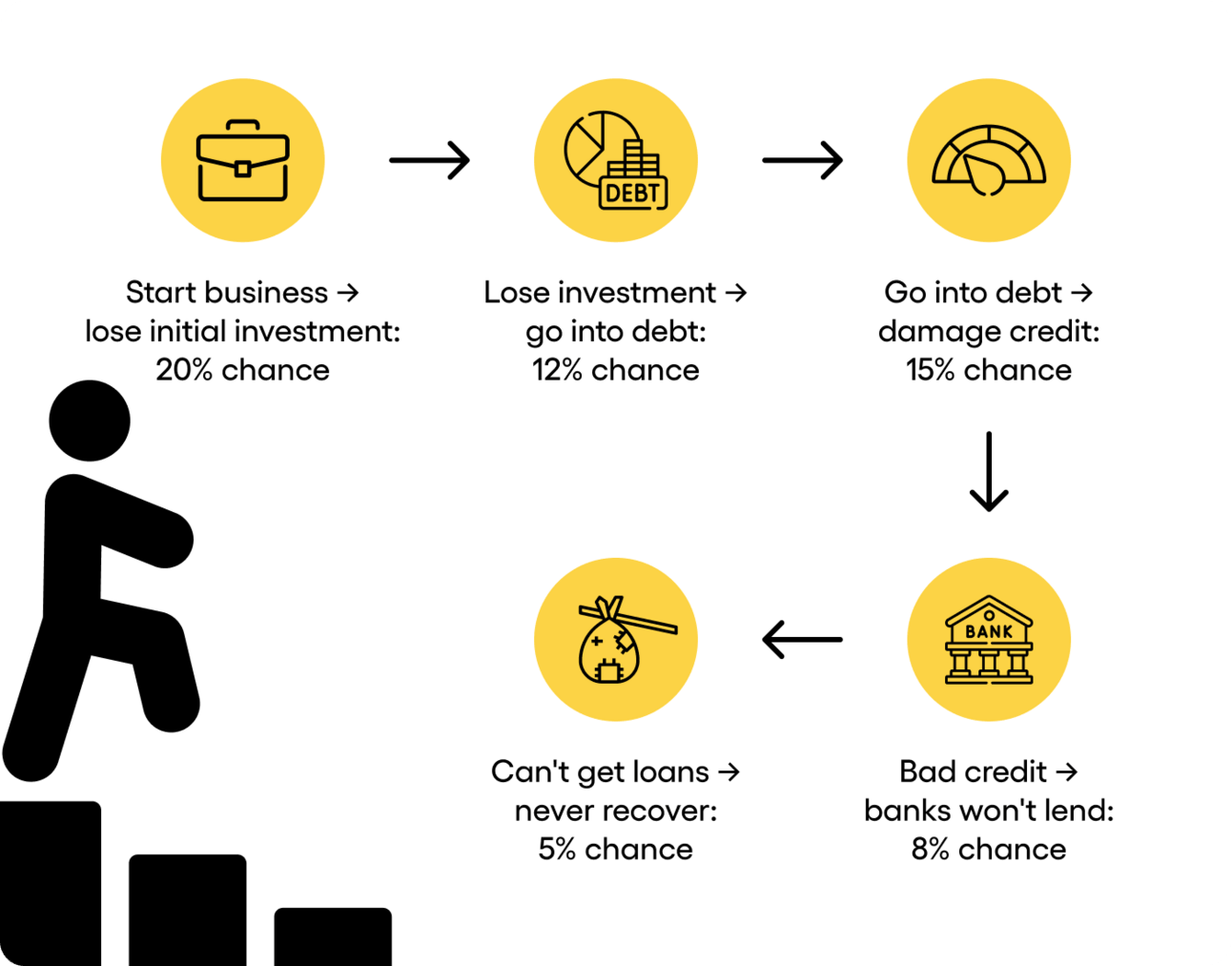

"If you start your own business → you'll lose your initial investment → you'll go into debt → you'll damage your credit → banks won't lend to you → you'll never recover financially."

Then they asked: "How likely is this entire chain?"

People said "very likely."

But when researchers asked about each step separately:

Multiply them: 20% × 12% × 15% × 8% × 5% = 0.0144% chance of the full chain happening.

Our brains imagine these as one big event (80% likely) instead of separate, unlikely events (0.0144% likely).

Translation: Your worst-case career scenario isn't one big disaster waiting to happen. It's 5-7 separate, unlikely events that would all need to go wrong in sequence.

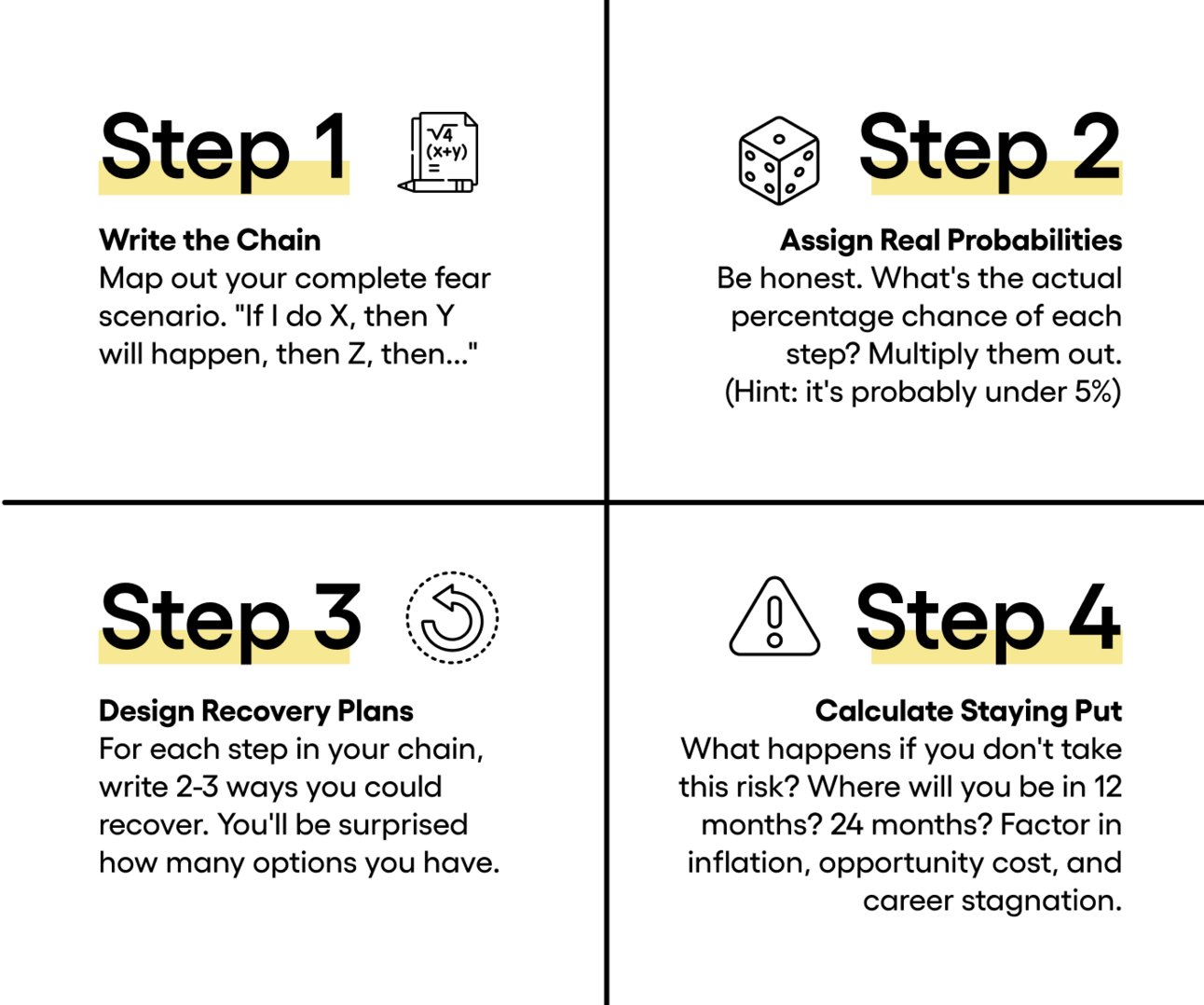

When I catch myself or others in slippery slope thinking, I use what I call the Reality Stack:

Layer 1: Probability Assessment

Instead of "What if this goes wrong?" ask "What's the actual likelihood of each step in this chain?"

Real example from my portfolio: Founder was afraid to hire his first employee because "What if I can't pay salaries, then I'll have to fire people, then I'll get a bad reputation, then no one will work for me."

Reality check:

Probability of not being able to pay one salary for one month: 15% (he had 6 months runway)

Probability that one late payment ruins his reputation forever: <1%

Probability that this prevents future hiring: Nearly 0%

Layer 2: Recovery Capability

Ask: "If the worst case happens, what are my actual options?"

Most people stop at "I'll be ruined." But when you actually map recovery options, you realize you're more resilient than you think.

That same founder realized: worst case, he pays salary from personal savings for 2 months while finding new revenue. Not ideal, but definitely manageable.

Layer 3: Opportunity Cost

The question nobody asks: "What's the cost of NOT taking this risk?"

Staying in your current situation isn't free. Every month you don't take that calculated risk, you're choosing stagnation. The compound cost of playing it safe is often higher than the risk you're avoiding.

Think of one decision you've been postponing because of worst-case thinking. Now run it through this process:

📊 Data of the Week

Sometimes, it’s better not to take risks too (in the above situations) 😆

Have questions? Click below,

I read each and every one of your emails.